Bangladesh Tax Compliance Map

Email: dac4ww@evershinecpa.com

A-16, 1st Floor, Aruna Asaf Ali Marg, Qutub Institutional Area, Dhaka, 110067, Bangladesh

Manager Punit Singh Negi, speak Bangladeshn and English.

Skype: cspunitnegi

GLA – Bangladesh Corporate Income Tax

GLA-BD-01 GLA Tax Entity

Is Bangladesh corporate income tax a national income tax? A local income tax? Or is there a national and local income tax?

What if the national income tax and the local income tax are levied separately or levied together?

What is the standard tax rate? What is the special tax rate?

Evershine RD:

Bangladesh is a unitary state.

The government enforces laws for the whole country; local bodies do not have any legislative authority.

National income tax is levied together.

Corporate tax rates in Bangladesh are generally as follows:

Publicly traded companies – 22.5%

Non-publicly traded companies – 30%

One person companies (OPCs) – 25%

GLA-BD-02 Registration

Which government unit is responsible for the collection of Bangladesh corporate income tax?

The registration of the country’s corporate income tax status, that is, the tax certificate number application procedure, paper certificate number application? Or online account application? URL?

What is the advance certificate number for applying for this certificate number?

Do I need to use the industrial and commercial certificate electronic card to apply?

Evershine RD:

The National Board of Revenue (NBR) administrates the tax system in Bangladesh.

Electronic Tax Identification Number (e-TIN) certificate can be registered manually or electronically in NBR website via https://secure.incometax.gov.bd/TINHome.

GLA-BD-03 GLA Order (OD)

What is the order of Bangladesh corporate income tax return (information flow determines tax base) and payment (fund flow)?

Pay first and then declare? Report first and then pays? At the same time as the declaration and payment?

Evershine RD:

Deposit first (DF). Pay by installment first and declare later.

GLA-BD-04 Mechanism of Filing (MOF)

What is the return method for Bangladesh corporate income tax return (information flow determines the tax base)?

Filing cycle: monthly? Every bimonthly? Every season? every half year? Per year?

Electronic filing? Manual filing? Electronic filing and manual filing coexist? If electronic filing is possible: website URL?

Evershine RD:

Annual corporate tax return must be submitted on or before the 15th day of the 7th month after the end of the income year.

Therefore, based on the default taxable year, the filing deadline for income years ending on June 30 is January 15 of the following year, and for calendar years (i.e., for financial institutions) is September 15 of the following year.

Where the deadline falls on a public holiday, the due date is the next working day.

Companies must file their income tax return on paper.

GLA-BD-05 Mechanism of Payment (MOP)

What is the funding method for Bangladesh corporate income tax payment (funds flow)?

Payment cycle: M per month? B every bimonthly? Q every season? H every six months? A every year?

Automatically authorize deduction of ACH (that is, take the initiative of the recipient)?

Electronic remittance to EFT (that is, the payer takes the initiative)?

Bank counter payment OCT? Or the above methods coexist?

Evershine RD:

Corporate income tax must be paid by way of advance payment if the company’s total income for the latest income year in respect of which it has been assessed by way of regular or provisional assessment exceeds 600,000 Taka.

Advance tax must be paid in 4 equal installments on September 15, December 15, March 15 and June 15 of the financial year, the tax is credited against the final tax assessment.

The final tax, less advance payments made, is payable on or before filing the annual corporate income tax return.

Payments can be made electronically, or by check, payment order or treasury challan.

VAT – Bangladesh VAT

VAT-BD-01 VAT Tax Entity

Is Bangladesh VAT National VAT? Local VAT? Or is there a national plus Local VAT?

What if the National VAT and Local VAT are levied separately or levied together?

What is the standard VAT rate? What is the special VAT rate?

Evershine RD:

The Government of People’s Republic of Bangladesh (GOB) and the Tax Authority publish Statutory Regulatory Orders (SROs) and Government Orders (GOs) from time to time, which govern and regulate the VAT regime, including VAT exemptions and administrative processes.

These are notified in the Official Gazette.

VAT applies to supplies made within the entire geographical territory of Bangladesh.

VAT rates as follow:

Standard rate: 15%

Reduced rates: 2%, 2.4%, 5%, 7.5% and 10%

Other: Exemptions and zero-rate

VAT-BD-02 Registration

Which government unit is responsible for the levying of VAT in Bangladesh?

The registration of Bangladesh’s VAT levy status, that is, the application procedure for VAT certificate number, paper certificate number application? Or online account application? URL?

What is the advance certificate number for applying for a VAT certificate number?

Do I need to use an industrial and commercial certificate electronic card to apply?

Evershine RD:

VAT is regulated by the Customs, VAT and Excise Department of the NBR.

VAT registration certificate can be obtained via online, on the website of the Bangladesh Tax Authority or any Tax authority service Centre.

For the link, visit https://vat.gov.bd/sap/bc/ui5_ui5/sap/zmcf_pri/index.html#/Welcome

Upon registration, a Business Identification Number in the format 001234567 is issued to the registrant.

Registration threshold is 30 million takas under Section 2(57) of the VAT Act.

However, Section 4(2) of the VAT Act provides that regardless of turnover, VAT registration is mandatory for:

- Suppliers, manufacturers and importers of goods and services subject to supplementary duties

- Suppliers participating in tenders

- Importers or exporters and

- Any other supplies as specify by the NBR

Under Rule 4 of the VAT Rules, a taxpayer must register for VAT, or enlist for turnover tax, within 15 days of becoming obliged to register or enlist.

VAT-BD-03 WWT Order (OD)

What is the order of Bangladesh’s VAT declaration (information flow determines the tax base) and payment (fund flow)?

Pay first and then declare? First declare and then pay? At the same time as the declaration and payment?

Evershine RD:

Deposit First (DF): Pay the taxes before filing of VAT return.

VAT-BD-04 Mechanism of Filing (MOF)

What is the return method for Bangladesh VAT declaration (information flow determines the tax base)?

Reporting cycle: every month? Every bimonthly? Every season? every half year? Per year?

Electronic filing? Manual filing? Electronic filing and manual filing coexist?

If electronic filing is possible: Website URL?

Evershine RD:

Under Section 64 of the Bangladeshi VAT Act, monthly VAT returns must be submitted by the 15th day of the month following the month being reported on, or the next working day if the 15th is a public holiday.

The taxpayer must submit returns to the concerned Tax Authority Officer in the administrative division where the taxpayer is registered, using form Mushak 9.1.

Electronic filing is mandatory in Bangladesh for entities with annual revenues of 50 million takas or more.

Visit the link for VAT online Services,

https://vat.gov.bd/sap/bc/ui_ui5/sap/zmcf_pri/index#/Welcome

VAT-BD-05 Mechanism of Payment (MOP)

What is the funding method for Bangladesh VAT payment (funds flow)?

Payment cycle: M per month? B every bimonthly? Q every season? H every six months? A every year?

Automatically authorize deduction of ACH (that is, take the initiative of the recipient)?

Electronic remittance to EFT (that is, the payer takes the initiative)?

OCT payment at the bank counter? Or the above methods coexist?

Evershine RD:

Under Section 45(2) of VAT Act, VAT on goods and services supplied during a particular tax period is payable before filing of the monthly VAT return for that tax period.

Rule 25 of the VAT Rules requires that documentary evidence of payment of VAT be submitted with VAT Return.

Bangladeshi VAT payments are made online or via Treasury Invoice containing the Government Treasury’s account code.

It can also be prepared by the Pay Order instruction and remit the TDS through an income tax challan into the Bangladesh Bank or the Sonali Bank.

Payments of amounts greater than 5 million takas must be made electronically.

Please be aware of below Warning:

The above contents are digested by Evershine R&D and Education Center in October 2021.

Regulations might be changed as time goes forward and different scenarios will adopt different options.

Before choosing options, please contact us or consult with your trusted professionals in this area.

Contact Us

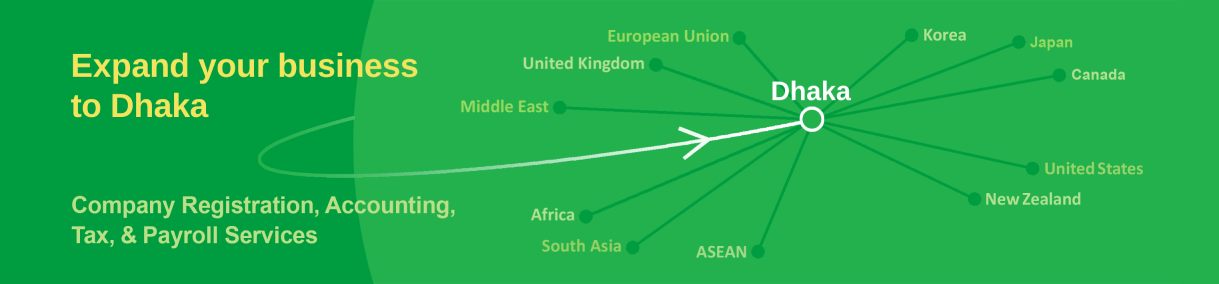

Dhaka Evershine BPO Service Limited Corp.

Email: dac4ww@evershinecpa.com

A-16, 1st Floor, Aruna Asaf Ali Marg, Qutub Institutional Area, Dhaka, 110067, Bangladesh

Manager Punit Singh Negi, speak Bangladeshn and English.

Skype: cspunitnegi

Additional Information

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shanghai,

Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo,

Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur,

Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt,

Paris, London, Amsterdam, Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico.

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Phoenix, Michigan, Seattle, Delaware;

Berlin, Stuttgart;Paris; Amsterdam; Prague; Czech Republic; Bucharest;

Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please send email to HQ4dac@evershinecpa.com

More City and More Services please click Sitemap